The benefit of using futures

- Cost-effective. Dynamic exposure management using futures-based risk management overlays avoids the high cost of implied volatility embedded within option pricing. Typical option-based strategies will lower costs by either lowering protection or increasing complexity and execution risk.

- Enhanced liquidity and scalability. Exchange-traded futures markets globally dwarf the liquidity of associated option markets. Lower liquidity translates to higher transaction costs for options, particularly in periods of stress.

- Customization. Futures-based risk management strategies have high levels of flexibility relative to options-based strategies that are restricted by liquidity. Futures-based strategies are more efficient at keeping portfolio protection levels relevant across market cycles.

Investors find themselves in a quandary. They need to invest in growth assets if they are to have any hope of achieving the level of returns they need to fund decades in retirement. And yet they are surrounded by structurally-low interest rates around the world while markets are beset by ongoing volatility.

Risk management: Two approaches

A variety of ‘new’ approaches have been introduced in the years following the GFC that offer to help the nation’s retirees navigate these issues.

While they go by a variety of names – low volatility, objectives-based strategies, absolute return strategies, and managed risk overlays – they can broadly be classed into two philosophies.

The first strategy gives a fund manager greater discretion to manage portfolios in response to extreme market conditions. An increasing number of Australian fund managers are now entering the risk management field by using options.

The second strategy relies on a risk management specialist to protect portfolios from extreme volatility and sharp capital losses by using a replicable process using futures.

Fund managers have a variety of skills which add value for investors. However, we argue that those fund managers using options as a risk management strategy are far less effective.

The history of futures

Farmers have used futures to hedge their risk for hundreds of years. Commodity futures, still popular today, allow farmers to sell their goods immediately (spot trading) or under a futures contract, helping to lock-in prices and stabilise supply.

The first modern commodities exchange, the Dojima Rice Exchange, was founded in Japan by the samurai (who were paid in rice) in 1697 so they could manage their commodity risk.

Futures contracts officially began trading in 1972 and now apply to a far wider range of securities such as stocks, currencies and bond markets around the world.

Futures have been tested over hundreds of years and the instrument remains one of the most effective tools to manage risk.

Cost-effective

The cost of using futures is lower than using options. The futures market is not only more liquid than the options market – the pricing is calculated differently. The price of options (whether bought on an exchange or via an investment bank) is directly tied to implied market volatility.

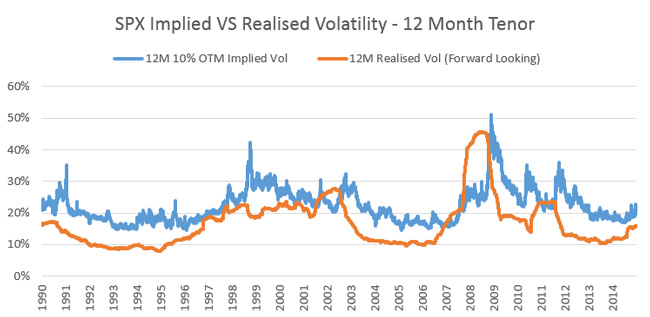

Unfortunately, implied volatility is significantly higher than actual market volatility over long periods of time, which raises costs. (While implied market volatility can be lower than actual market volatility in the short-term – often preceding an unexpected market crisis – trying to time the market is a game few investors can risk losing.)

It is understandable that an option seller demands compensation for unknown risks and their cost of capital in selling options. However, when building protection strategies, these input costs for options are compounded over time creating excessive drag on the underlying portfolio.

For example, the following graph shows the market implied volatility for 12-month ‘at the money’ options for the S&P 500 index. On average, implied volatility was 2.95 percentage points greater than realised volatility. Since 2010, this implied volatility premium has averaged 4.20 percentage points greater than realised volatility.

In pricing a 12 month at the money put, this extra 3-4% implied volatility premium roughly equates to an added 150 bps per dollar notional amount to be protected.

(Source: Bloomberg/Milliman)

Instead, using a dynamic hedging strategy, where exposure to the market can be managed via exchange-traded futures, hedging costs can be reduced. While futures can leave a small gap risk – the chance that a security will materially change price in the time between one trade and the next – the implied volatility premium of options destroys any protective benefits over the long-term. (Risk management specialists can also combine a small exposure to options with futures to effectively cover this risk.)

The behavior of investment banks is also telling: they sell options to the market, take a margin, and then trade futures to offset their position.

Investors may be better served by cutting out the cost of the middle-man and using futures to hedge their risk exposures.

Liquidity and scalability

Futures offer significantly more flexibility to tailor a portfolio’s risk-return dynamics over the medium-to-long term because the market is larger.

By contrast, the market for options in Australia is small and typically illiquid beyond 1-2 years, which is a particularly short time period for risk-conscious investors.

According to ASX annual volume data, the annual notional volume traded in 2014 for S&P/ASX 200 futures was over $1.2 trillion. In comparison, all S&P/ASX 200 index options traded totaled less than $30 billion.1

Prudent option trading fund managers would limit their capacity based upon this limited liquidity.

For example, a fund manager employing an option trading strategy using three-month options has a total volume of $7.5 billion to operate in.2 In order to avoid becoming the entire market, any responsible trading strategy would limit capacity to less than 10% of the total volume or $750 million in Australia. However, some managers are happy to accept more funds under management.

Single stock options face less liquidity, while gaining more capacity via ‘over the counter” trading incurs credit counterparty risks with banks.

By intelligently using futures, it is possible to create an option-like payoff which doesn't exist in the market, such as a rolling five-year option. This flexibility and longer investment time horizon is crucial for investors who can ill afford short-term risk protection.

The greater depth and breadth of the futures market is also crucial in times of crisis.

When markets are under extreme stress, this depth and liquidity means it is easier to transact and effectively manage risk. Many investors are still reeling from the high cost of options during the GFC, which also exposed counterparty risk.

Risk management specialists with global scale and operations are best placed to take advantage of the greater depth offered by futures markets.

Keeping portfolio protection relevant

Option strategy marketing materials commonly refer to simplistic option payoff diagrams depicting simple “hockey stick” return profiles when options expire.

However, these profiles fail to account for decisions that need to be made during the life of an option.

For example, if a portfolio purchased a one-year 10% out of the money put option and at six months to expiry the market had moved up 10% since inception of the option – what action should the manager take?

The option now has a protection level that is 20% below the value of the fund. In order to keep the protection level relevant, a new option needs to purchased, increasing costs. In this example, the cost to protect a portfolio using options may have moved from 4% a year to over 7% for that year.3

Alternatively, because these costs are high; the portfolio manager may take no action and simply wear more downside risk after the market has run up.

Importantly, without a rules-based approach, these decisions become reliant upon discretionary calls reducing predictability of the risk management strategy. These issues are compounded by the fact that open ended investment vehicles have irregular fund flows.

Simplicity

There are a number of ways to reduce the cost of options when attempting to hedge risk in a portfolio. Most will either limit protection (put spreads), seek to time the market or introduce more complexity including trading the volatility term structure.

Option strategies, which rely upon discretion and greater complexity become opaque and are not predictable in how they will handle the next market crisis. The opportunity to make the wrong call at the wrong time – when markets are under extreme stress – is particularly heightened.

In the wake of the GFC – and when markets are in deep crisis – investors need simplicity and transparency within a dependable strategy.

Futures have the depth, liquidity and a long-term time horizon to underpin effective risk management.

1 http://www.asx.com.au/prices/daily_monthly_reports.htm

2Annual volume of $30 billion divided by four quarters.

3Given the put protection is rolled higher by purchasing another one year 10% out of the money put and selling the original option.

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.

Any index performance information is for illustrative purposes only, does not represent the performance of any actual investment or portfolio. It is not possible to invest directly in an index.