The financial services industry may have underestimated the dramatic falloff in retiree spending as retirees age, according to a Milliman analysis of real-world expenditure data.

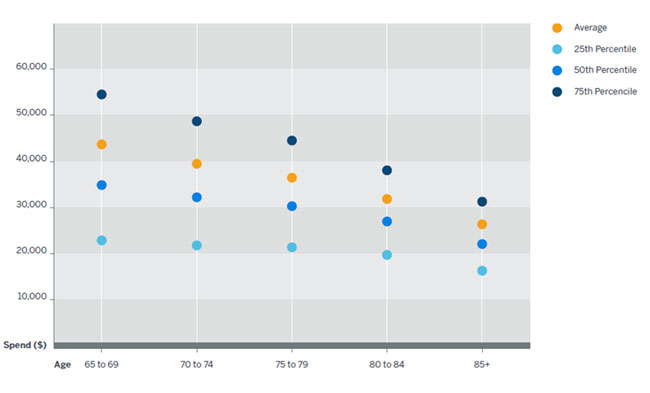

The median retired couple’s expenditure falls by more than one-third (36.7%) as they move from their peak spending years in early retirement (65 to 69 years of age) and into older age (85 years and beyond). The decline in expenditure for couples is relatively stable in the early years of retirement at about 6% to 8% across each four-year age band, but then rapidly accelerates once retirees pass 80 years of age.

The revelation undermines common practices such as linking pension products (including for upcoming MyRetirement defaults), to a rising consumer price index (CPI), as well as industry assumptions such as the 70% replacement ratio for retirement income.

The result is many retirees are holding money back for future years when they will never spend it.

Figure 1: Spend by wealth band (Couples)

Association of Superannuation Funds of Australia (ASFA) has previously estimated a “comfortable” couple aged 85+ years will spend about 7.8% less than those aged 65-85 years of age. Another industry study by the Australian Institute of Superannuation Trustees (AIST), based on Household, Income and Labour Dynamics in Australia (HILDA) data, has suggested that spending may not decline materially through retirement.

However, the Milliman Retirement Expectations and Spending Profiles (ESP) analysis is the first based on the actual spending of more than 300,000 Australian retirees.

The data shows that retirees’ food expenditure–the largest component of essential spending –declines steeply with age, while health spending increases with age but dips again after age 80. All discretionary expenditure, such as travel and leisure, declines throughout retirement.

While the Retirement ESP currently compares the spending of different retirees at a single point in time rather than the same retirees through time, this is the same modelling used in the ASFA comparison.

Future editions of the ESP will track and compare the same cohort of retirees through time to show whether older Australians are spending less simply because they are retiring with smaller super balances than younger retirees (85-plus year olds would have had comparatively few working years with compulsory super).

However, the Retirement ESP already shows that the top (75th) percentile of retirees aged 85-plus are still spending at or below the Aged Pension, which can’t be explained by the cohort effect.

The faster-than-expected drop-off in spending casts doubt on some common rules of thumb, such as aiming to save enough super to replace a set percentage of pre-retirement income and suggests a more nuanced approach.

Better information can meet the concerns of retirees

Older Australians are bombarded with broad brushstroke messages about how much they need for retirement.

For example, a common target replacement rate is 70% of final earnings, which is used by the Organisation for Economic Co-operation and Development (OECD) and the Melbourne Mercer Global Pension Index to assess the adequacy of retirement systems around the world.

While this is useful to give a comparable system-wide view between retirement systems, it does not reflect the experience of individual retirees as they age.

At worst, it could mislead retirees who then underspend during the early years of retirement when they are most active. We know this is an issue for many retirees who opt to take their super as an allocated pension and then draw down the minimum income.

Financial plans and products should reflect these expenditure changes over time as well as the greater risks (such as market downturns) and uncertainties (such as health events) that retirees face compared to the broader population.

However, many products aimed at retirees assume that their spending will rise in line with the CPI. More than half (59% ) of all of balanced pension funds rank their performance against CPI, according to researcher SuperRatings.

The investment targets of some MyRetirement (or comprehensive income product for retirement - CIPR) defaults are likely to fall into the trap. The Australian Government Actuary released its certification test in May 2017, outlining the minimum requirements that CIPRs must meet. It will require that the constant real income delivered by CIPRs is indexed to CPI. The Milliman ESP analysis shows that retirees’ overall cost of living does not increase in line with CPI–rather, it falls–and that the components of their spending differs substantially. This means that CIPRs will assume an income target that is not in line with retirees’ lifestyles.

A more precise picture of retirees’ essential and discretionary spending can lead to more targeted products that also address their real concerns. Recent Australian Securities and Investment Commission (ASIC) research into the views of older Australians found five key financial worries:

- Paying day-to-day household bills and expenses (78%)

- Having enough money to enjoy life and do what they want to do (69%)

- Making sure they can access money for emergencies or something unexpected (54%)

- Paying healthcare or medical costs (45%)

- Saving for a holiday or travel (42%)

The Milliman ESP data provides a baseline for how retirees are likely to behave in the future –information they cannot know about themselves–and so help meet those concerns.

In this way, the financial services industry can provide more tailored advice and products that boost engagement and genuinely improve retirement lifestyles.

The full Milliman Retirement ESP report is published to subscribers each quarter. Contact Milliman senior consultant Jeff Gebler at [email protected] for more details.

Disclaimer

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.