Many Australians remain unprepared to tackle the risks of retirement.

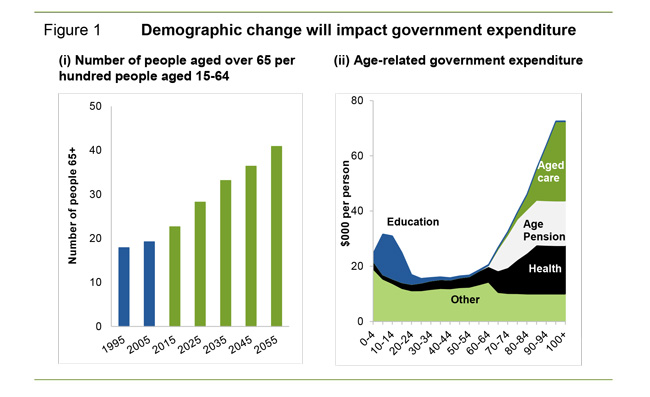

This represents a major hazard not just to the future wellbeing of retirees but also to future generations as the needs of older Australians weighs down the government’s balance sheet.

While Australia’s superannuation system is one of the largest in the world with approximately $2 trillion in assets,1 the incomes of more than two-thirds of people aged over 65 are bolstered by the government’s Age Pension2 ‘safety net’.3

The average super balance at retirement is just $197,000 for men and $105,000 for women, although the average couple needs just over $500,000 to ensure that they can live comfortably in retirement.4

It is an issue which needs to be tackled realistically but is being exacerbated by a perception gap.

More than 60% of individuals aged 55 to 59 expect to self-fund their retirement, according to recent Australian Bureau of Statistics data, but less than 20% are meeting those expectations.5 Similarly, many Australians don’t believe they will live as long as they are likely to: Women underestimate their life expectancy by an average of around five years and men by three years.6

Similar issues are facing investors around the developed world as the Baby Boomer generation approaches retirement.

In the United States, people aged 55 to 64 who responded to an online BlackRock survey said they expected to have about US$45,500 in annual retirement income, when the amount they had saved would only provide an estimated US$9150.7

The situation can only be improved by shifting three main levers—and the most important one also comes with significant risk.

Investors need growth but remain wary

To improve their retirement, Australians can save more, spend less, or generate higher returns from their investments.

Whatever the mix—and good financial advice can help determine the optimal combination—the majority of Australians will be unable to fund decades in retirement without a healthy allocation to growth assets such as shares.

However, many investors remain risk-averse after the impact of the global financial crisis stripped almost one-third from superannuation balances.8

For example, older self-managed super fund (SMSF) investors were more conservative with their investments than those aged 18 to 44, according to the FSC/UBS December 2015 SMSF Report.9 It found that younger investors were more than twice as likely to use leverage as an investment strategy or be considering diversifying into international investments (shares, bonds, or property) compared with older adults.

The recent introduction of MySuper lifecycle default funds is also lowering the investment growth exposure of many Australians.

Lifecycle funds slowly lower the allocation to growth assets as an investor approaches retirement. They account for $137.2 billion in super assets10 or nearly 7% of the industry and are growing quickly.

MySuper and the rise of lifecycle funds

| Sep 2014 | Dec 2014 | Mar 2015 | Jun 2015 | Sep 2015 | |

| Total MySuper assets ($b) | 375.2 | 393.0 | 420.2 | 428.4 | 433.1 |

| Lifecycle fund assets ($b) | 114.0 | 120.9 | 131.5 | 132.9 | 137.2 |

| Source: APRA | |||||

Research by Warren Chant and CIPR suggests that this reduced exposure to growth assets costs investors about 1% a year in lower net returns (but with the benefit of 10 basis points in lower fees).11

This retreat from growth is understandable given the negative impact that a sharp market downturn can have close to retirement or when retirees are drawing down their funds.

However, it also serves to exacerbate longevity risk—the chance that Australians will outlive their retirement savings. Australians expect their retirement to last an average of 23 years, but their savings and investments will run dry after only 10 years in retirement—the largest gap in Asia and fourth largest globally—according to HSBC research.12

Faced with the prospect of government entitlements being wound back, Australians need a more nuanced approach which allows the benefits of growth while minimising the risk that comes with it.

The search for asymmetric returns

It takes a range of strategies to preserve long-term investment objectives while managing the impact of short-term volatility and potential for capital losses.

Investment strategies need to look beyond simple diversification and employ a multi-layered approach which moves in direct response to market conditions.

The intelligent use of derivatives such as futures may offer a cost-effective way to manage these risks while retaining the potential for much-needed growth.

In effect, the investment return profile becomes asymmetric.

The lessons from the global financial crisis need to be learned before the next major market downturn strikes. More than two-thirds of super fund executives say they expect another major market downturn to strike over the next decade, according to a recent survey.13

It is a risk that retirees and older Australians cannot afford to take.

1Australian Prudential Regulation Authority (September 2015). Statistics: Quarterly Superannuation Performance. Accessed 13 January 2016, at http://www.apra.gov.au/Super/Publications/Documents/1511-QSP-1509.pdf.

2Productivity Commission (7 July 2015). Superannuation Policy for Post-Retirement. Research paper. Accessed 13 January 2016, at http://www.pc.gov.au/research/completed/superannuation-post-retirement.

3The Age Pension represented the federal government’s largest spending program (aside from state and territory funding) in 2013-2014 at $39.4 billion, propping up the finances of 2.4 million pension recipients. See Productivity Commission research paper, Superannuation Policy for Post-Retirement.

4Association of Superannuation Funds of Australia (March 2015). The Future of Retirement Income. Based on most recent Australian Bureau of Statistics data from 2011-2012. Accessed 13 January 2016, at http://www.superannuation.asn.au/ArticleDocuments/1089/ASFA_SSgA_RetirementSavings_March2015.pdf.aspx

5Productivity Commission, Superannuation Policy for Post-Retirement.

7BlackRock Global Investor Pulse Survey. Available at http://blackrockinvestorpulse.com/retirement. Quoted in Davidson, K. (October 26, 2015). Baby Boomers Hugely Underestimate What They Need for Retirement. Wall Street Journal. Accessed 13 January 2016, at http://blogs.wsj.com/economics/2015/10/26/baby-boomers-hugely-underestimate-what-they-need-for-retirement/.

8Productivity Commission, Superannuation Policy for Post-Retirement.

9SMSF Insights: FSC/UBS SMSF Report. (December 2015). Financial Services Council and UBS Asset Management (Australia) Limited. Accessed 13 January 2016, at http://www.fsc.org.au/downloads/uploaded/2015_1203_FSC%20UBS%20SMSF%20Report%20WEB%20FINAL_17d3.pdf.

10Australian Prudential Regulation Authority, Statistics: Quarterly Superannuation Performance.

11Chant, W., Mohankumar, M. & Warren, G. (April 2014). MySuper: A New Landscape for Default Superannuation Funds. Centre for International Finance and Regulation research report. Accessed 13 January 2016, at http://www.cifr.edu.au/assets/document/MySuper%20Landscape%20-%20April%202014.pdf.

12Australians face a 13-year shortfall in retirement funding: HBSC research. (19 January 2015.) HSBC. Accessed 13 January 2016 at http://www.about.hsbc.com.au/news-and-media/australians-face-a-13-year-shortfall-in-retirement-funding-hsbc-research.

132025: What will the superannuation industry look like in a decade? (13 March 2015). AIST/BNP Paribas. Survey conducted February 2015. Accessed 13 January 2016 at https://www.aist.asn.au/media/14323/2025%20-%20Superannuation%20in%20a%20Decade.pdf.

Issued by Milliman Pty. Ltd. (Milliman AU) (ABN51 093 828 418) (AFSL 340679) Please contact Milliman to obtain more information about the products and services we offer as not all products and services may be suitable for you.

The Milliman Managed Risk Strategy is available only to persons who meet the requirements for a "wholesale client" under the Corporations Act and trustees of superannuation funds with net assets of at least A$10 million (Clients). Clients must have an agreement with Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman) to implement the strategy (Service) against a portfolio of the Client's equity investments (such as listed shares), which enables the Client to use the Service or to offer the Service to members of the Client's superannuation fund.

Milliman makes no recommendation and gives no statement of opinion to Clients, members of Clients' superannuation funds or their respective advisers in relation to use of, or any investments, in the Service. Before considering whether to use the Service, Clients may wish to obtain professional advice (including taxation advice). Investments in, the Service are subject to market and other risks, and no guarantee or assurance is given by Milliman that such investments will not give rise to losses or that performance of the Service will completely reflect inversely the performance of equities markets generally or a Client's portfolio of equity investments. While generally assets which are acquired through use of the Service will be liquid, this may not be the case in all circumstances. Further, during periods of sustained market growth, the return to Clients from the combination of their portfolio of equity investments and assets held in the Service should be less than if the Client did not participate in the Service. Fees and conditions apply to use of the Service.