Sydney-based retirees who rent privately may have to save more than four times the amount of superannuation if they expect to live the same lifestyle as homeowners who own their homes outright, according to the latest Milliman Retirement Expectations and Spending Profiles report.

It raises a new aspect to the housing affordability debate as skyrocketing property prices squeeze a generation out of the home ownership market.

The median retired Sydney homeowner aged 65-69 spends $31,987 a year, with the Age Pension (which is not affected by the value of the family home) funding the bulk of expenditure.

Older Sydney residents stuck in the private rental market are not so fortunate. They must find a further $21,679 a year, based on CoreLogic median estimates net of Centrelink Rent Assistance.

This makes their annual cost of living two-thirds higher to fund the same quality of life enjoyed by homeowners. While Sydney has the highest rental costs, other capital cities show similar trends.

Figure 1: Median annual spend including rent payments

Source: Milliman Retirement Expectations and Spending Profiles Q1 2017

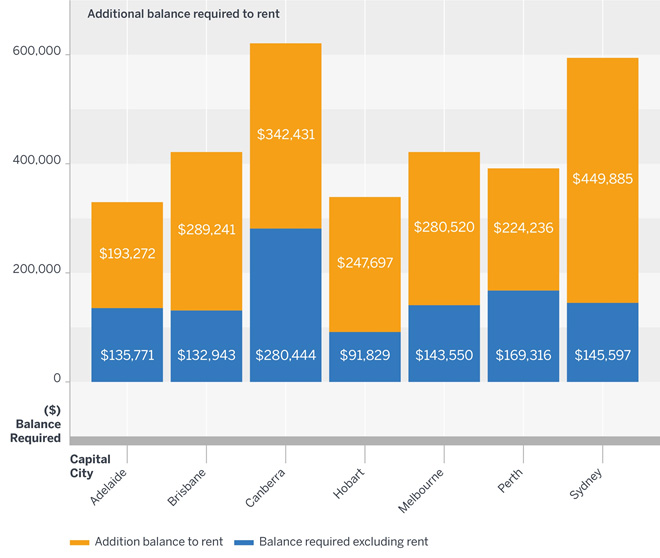

These differences in annual expenditure have even more significant repercussions for the level of super savings needed at retirement.

To fund the median Sydney homeowner’s annual expenditure through retirement with 75% certainty requires a balance of just $145,597 (largely because of Age Pension support). However, to fund non-homeowners’ much higher annual expenditure through retirement with the same certainty would require a super balance of $595,482.

These forecasts are based on Milliman’s sophisticated stochastic modelling assessing thousands of scenarios across a balanced investment option including variations in returns, inflation, spending drawdowns and the impact of the Age Pension.

Figure 2: Superannuation balance required to rent (75% certainty)

Source: Milliman Retirement Expectations and Spending Profiles Q1 2017

These issues currently only affect a small number of retirees although the problem is likely to flare up in coming years given that the level of home ownership is plunging across all other age groups.

Around three-quarters of older Australians are homeowners while 7.3% live in private rentals, according to a recent Productivity Commission report.

However, the Household, Income and Labour Dynamics in Australia (HILDA) Survey shows home ownership levels for people aged 35–44 dropped from 63.2% to 52.4% between 2002 and 2014. Similarly, home ownership levels among people aged 45–54 declined from 75.6% to 67.4% over the same period.

Investor activity, partially driven by negative gearing and capital gains tax concessions, has risen from a little over 30% of all loan approvals in 2011 to almost 40% recently, according to a recent Reserve Bank of Australia submission to a government inquiry about home ownership.

Australian residential property, led by Sydney and Melbourne, now ranks among the most expensive in the world. Since June 2012, residential property prices across Australia’s capital cities have climbed by a cumulative 47.3% with Sydney prices up 74.9%, according to CoreLogic.

Meanwhile, many Australians, encouraged by historic low interest rates, have gone on a debt binge. The household debt-to-disposable-income ratio now stands near a record 190%.

Outright home ownership has traditionally been seen as key to avoiding poverty in old age. However, as housing affordability edges further out of reach, this could lead to a greater proportion of older Australians paying off their homes well into retirement, acting as another drag on retirement living standards.

In recent months, state and federal governments have floated a number of potential policy changes aimed at improving housing affordability, particularly for first-time homebuyers. This new data shows that rising property prices are a problem we’re not growing out of with age.

Read more about the Milliman Retirement ESP here.

Disclaimer

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.