Does spending decline dramatically through retirement due to declining assets balances? Can individuals predict their retirement spending based on pre-retirement income?

New analysis by Milliman suggests that retirees’ age is just as strong an indicator of behaviour as income levels and casts doubt on common benchmarks, such as using a percentage of final salary as a retirement savings target, which make little allowance for lifestyle changes.

The Milliman Retirement Expectations and Spending Profiles (ESP) shows that the median retired couple’s expenditure falls by more than one-third (36.7 %) as they move from early retirement (age 65 to 69) and into older age (85 years and beyond).

However, this new analysis includes the latest census income data, revealing that poor, middle-income and high-income retirees all show similar declines in expenditure throughout retirement.

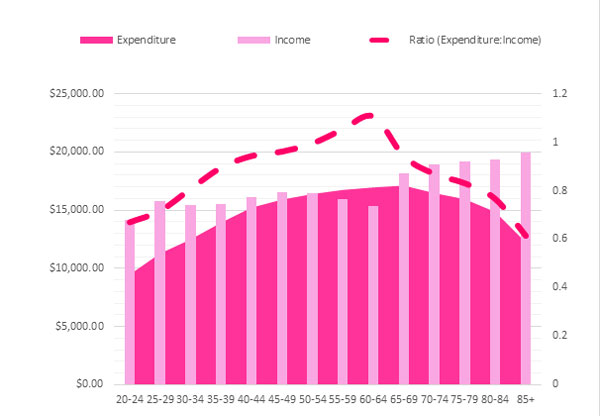

The graph below tracks personal income (using census data) against expenditure (using the Milliman Retirement ESP) for low-income retirees (annual income below $33,800). While expenditure briefly peaks above income just before retirement, it quickly tapers off into older age.

Figure 1: Personal income vs. household expenditure (LOW)

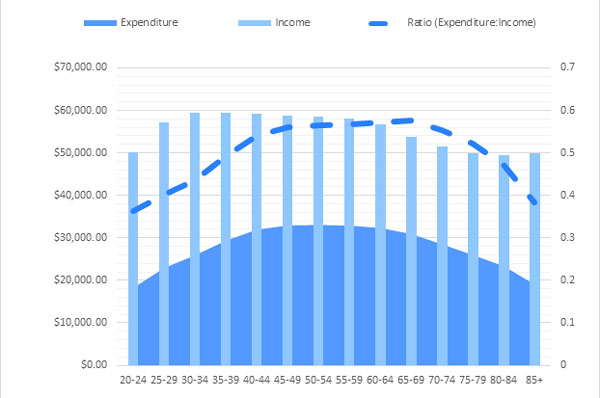

Middle-income retirees (annual income between $33,800 and $91,000) also show similar declining expenditure (although their expenditure never exceeds income) as shown in the graph below.

Figure 2: Personal income vs. household expenditure (MID)

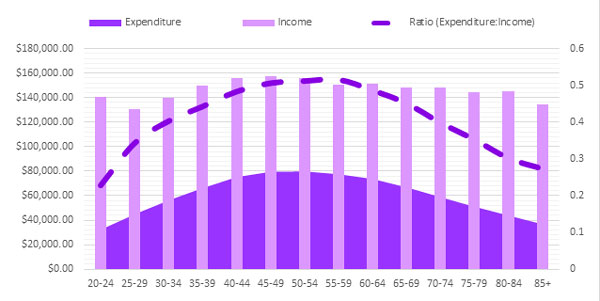

Similarly, high-income earners (annual income above $91,000) are also saving money into retirement as shown in the following graph.

Figure 3: Personal income vs. household expenditure (HIGH)

While wealthier retirees spend more in absolute terms, all three groups are saving money in retirement.

How spending changes in retirement regardless of wealth

The Milliman Retirement ESP provides the most accurate possible picture of retiree behaviour by tracking changes in the real-world expenditure of more than 300,000 older Australians.

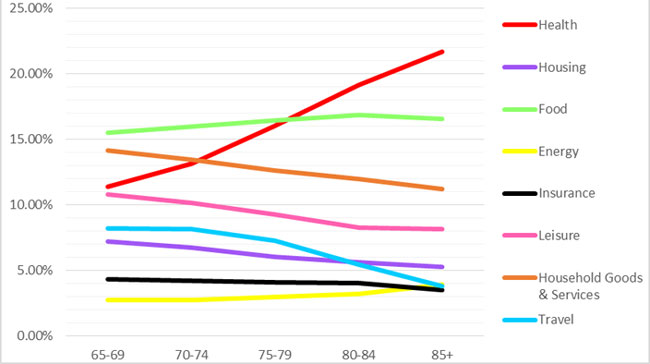

It shows that the average proportion of income spent on housing, food, energy, leisure, goods and services, travel and insurance either declines slightly, or remains the same, regardless of income levels, through retirement. Only expenditure on healthcare increases.

Figure 4: Average expenditure (Q2)

But while overall spending declines, there are still significant variations between the lowest and highest earners (these full results are available to subscribers). There are also important expenditure trends underway with home ownership levels declining in Sydney and Melbourne while energy prices are escalating quickly.

While energy represents a small proportion of overall household expenditure, the amount spent is significantly correlated to income levels: higher income households have more expensive (and energy-consuming) lifestyles.

Energy expenditure increases until about age 65 and then stabilises before rising from age 80 (this may be because elderly Australians spend more time at home and want to feel more comfortable rather than moving into aged care accommodation).

This data and the trends it reveals have important implications for super funds attempting to meet the needs of their members. It should feed into communication strategies, general and personal advice and product design.

In this way, funds can meet the actual lifestyle needs of their members.

The full Milliman Retirement ESP report is published to subscribers each quarter. Contact Milliman senior consultant Jeff Gebler at [email protected] for more details.

Disclaimer

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.