Retirees find themselves in a predicament.

On the one hand, they are being forced to take greater responsibility to fund their retirement as fiscally constrained governments struggle to meet the growing needs of an ageing population.

On the other, traditional means of generating steady retirement incomes have been weighed down by record low interest rates. It is a situation unlikely to change in the near term as central governments try to stimulate their economies and pay down the hefty deficits they built up to fight the global financial crisis.

It represents a perfect storm for Baby Boomers: accept substantial market risk to fund the necessary retirement income or suffer declining living standards for the first time in decades.

The risk tolerance paradox: A perfect storm

This paradox runs deep and creates a number of challenges for those seeking a secure retirement.

Life expectancies have steadily increased over the last two decades, but women still underestimate their lifespan by an average of about five years and men by about three years, according to a recent Productivity Commission Report.

Meanwhile, superannuation savings have not kept up. The median super balance for Australians aged 55-59 was just $47,000 in 2011-12 according to the Australian Bureau of Statistics and the Association of Superannuation Funds of Australia (ASFA).

And yet retirement expectations remain overly positive. Super savings remain well short of the joint $510,000 a couple needs to achieve a comfortable retirement, according to ASFA.

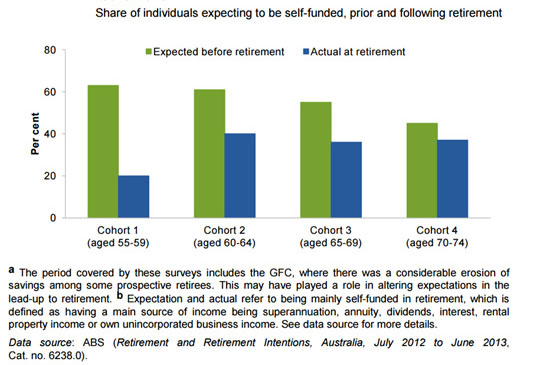

Figure 1: The perception gap: Expected vs. actual self-funding in retirement a, b

Many retirees have attempted to boost their super by moving up the risk curve and increasing their exposure to growth assets, such as high-yielding stocks.

However, the price is significant: greater uncertainty.

Traditional portfolio construction approaches exposed

The global financial crisis exposed the flaws in traditional portfolio construction techniques. Since then, there has been a growing awareness among investors that new approaches are needed to manage portfolios through periods when financial markets are put under extreme stress.

This reflects a growing exposure to sequencing risk – poor returns which strike at the wrong time – as people begin to maximise their retirement savings towards the end of their working lives.

As savings peak, the impact of returns on a portfolio is magnified. A period of negative returns which strikes just as a retiree draws down on their savings can be devastating.

Older investors’ ability to recover is limited because their ability to increase contributions or savings become more limited as their income-earning years naturally reduce.

Their risk profile is asymmetric: they want asset growth but are averse to losses. This loss aversion is a natural bias which prompts many investors to shift to low-risk assets such as cash when markets become volatile.

But this strategy often simply locks in losses while replacing market risk for longevity risk.

Using risk managed solutions to enhance returns

This risk tolerance paradox can only be solved by finding an efficient way to preserve long-term investment objectives while managing the impact of short-term volatility.

Portfolio management approaches that dynamically seek to manage risk and produce returns that are asymmetric are a natural response.

Introducing managed risk equities into the portfolio of clients close to (or in) retirement can provide exposure to higher returns while managing the inherent higher risk.

This can also have a material impact on the amount of income available during retirement while reducing the amount of sequencing risk to which clients are exposed as demonstrated in our paper: The 6% rule.

What to consider when using managed risk equities

There are a variety of investment approaches which tackle this growing issue and we will explore their advantages and disadvantages in detail in a future article.

In the meantime, investors should consider these key points when employing a risk management approach within client portfolios:

- Predictability: Are the outcomes of the strategy rules-based or will they rely on the manager’s discretionary skill?

- Reliability: These strategies must perform when markets are under extreme stress, which occurs infrequently. Can the manager demonstrate a strong track record during previous, similar market conditions?

- Efficiency: Is the strategy implemented in an efficient, low-cost manner? An investor should consider the merits of liquid and low-cost instruments versus expensive alternatives.

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.