A generational change is underway as a wave of retiring Baby Boomers tilt Australia’s $2.1 trillion super system from accumulation to drawdown.

They need growth but are highly sensitive to volatility. They need income but live in a low-inflationary world. They need short-term certainty but have one eye on the long-term.

Enter the “retirement consultant” with a new skill-set focused on the implications of drawdown, which can complement super funds’ traditional focus on accumulation.

A world in drawdown

Australians invested a net $34 billion into super last financial year, according to APRA. Those inflows and rising asset markets helped the entire super pot to edge 3.6% higher to $2.1 trillion.

But those numbers mask an important change underway – large and important segments of the market are already in drawdown.

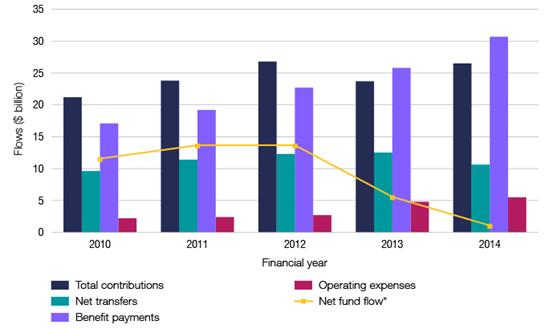

For example, net fund flows to the $600 billion-plus self-managed super sector (SMSF) fell by 91% between 2010 and 2014 with the industry now in net drawdown.

Figure 1: Breakdown of SMSF fund flows

Source: Australian Taxation Office.

The average SMSF investor has more than $589,000 in super savings while 59% of these 1 million-plus members are 55 years of age or older, according to the ATO.

Many of these investors have already left larger super funds in an effort to take more control of their retirement decisions.

It is partially a reflection of service. Their concerns are often at odds with younger investors still accumulating assets – and accumulating assets has been the dominant focus of the super industry.

But there is a growing awareness that accumulation is not the ultimate goal: new legislation will make it clear that the purpose of super is to provide income in retirement while the introduction of Comprehensive Income Products for Retirement (CIPRs) will underline that change.

Funds will need to change tack quickly if they are to engage and retain these older members.

New skills required

Superannuation funds have evolved since they were launched two decades ago. However, a heavy focus on accumulation has left its mark. A recent report by the Grattan Institute has in fact, questioned whether super funds deserve to be the hub through which members manage their retirement lifestyles.

As a consequence, funds are now rapidly reassessing their future and how to respond as members shift their priority to achieving a comfortable retirement lifestyle. This change requires new thinking, and new advice to funds seeking to maintain their relevance.

We believe this creates significant opportunities – enter the retirement consultant.

The modern retirement consultant will need to add and co-ordinate a broad mix of skills to meet the increasingly complex needs of the superannuation industry, including:

Actuarial

Funds have an increasing need for actuarial skills which can help them model member behaviour, changes in legislation and the impact of the Age Pension, risk management strategies, and post-retirement product design.

Data scientist

The business world is now awash with information thanks to advances in technology and affordability. The data scientist can analyse and turn this ‘big data’ into practical insights in areas such as membership, investments and risk.

Investment management

Funds and asset consultants have tended to focus on long-term returns generated during the accumulation phase. However, changing demographics and legislation suggest funds should increasingly focus on the risks of drawdown such as volatility and potential capital losses. With this comes an expanding list of relevant asset classes, many of which (such as derivatives) are traditionally beyond the expertise or depth of existing asset consultants.

Behavioural finance and communications

Funds need to design their products and services taking into account the behavioural tendencies of older investors. For example, financial literacy scores naturally decline by about one percentage point each year after age 60 while older investors are more prone to ‘loss aversion’ than younger investors.

Digital

Older investors are highly engaged with their super, including through digital channels. Automated-advice provider Decimal recently released research showing that older investors were the most active users of its enterprise financial advice service.

Bringing it together: the retirement consultant

The growing realisation that super funds must focus on managing members’ money for the best retirement outcome – rather than for the highest balance at retirement – makes the nature of the advice they require more complex.

A retirement consultant will bring important new retirement-focused skills to the table but few individuals or organisations will possess all of the skills needed. It will instead require a best-of-breed approach.

For example, in this new landscape asset consultants will no longer be able to provide all investment advice and may even require re-training to remain in line with funds’ new retirement-oriented focus.

A retirement consultant can help manage and co-ordinate this larger suite of advisors and ensure that they are all working towards the same goals. This also helps ideas to cross-pollinate across the organisation, ensuring the sum of advice is greater than its individual components.

This new approach will help funds play a key role in their members’ lives throughout retirement, rather than one that ends at retirement.