Biases are an innate part of being human. We all harbour a unique mix of experience and emotions which shape – and often mislead – our decision-making abilities.

Every poor choice erodes a small portion of the almost $2 trillion that Australians have saved in superannuation.

It is a risk few can afford to take with the median household super balance standing at just $110,000 for those on the verge of retirement (aged 60 to 64 years of age), according to an analysis by ASFA. The average couple needs far more – an estimated $500,000-plus- to live comfortably.

Loss aversion is a key behavioural bias which needs to be overcome if retirees are to have any chance of reaching that target.

Identifying loss aversion

Loss aversion is one of the most common and powerful behavioural biases.

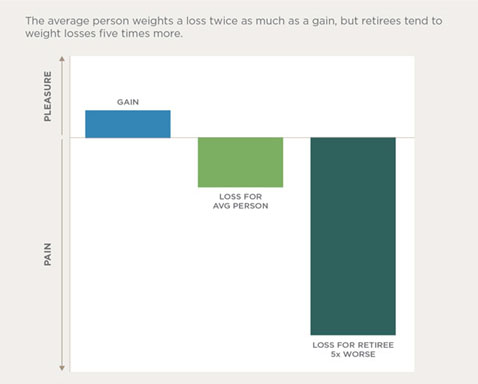

The average person feels the pain from a loss twice as much as the pleasure they feel from a financial gain, according to a 2007 study by AARP and the American Council of Life Insurers. From an emotional perspective, the pain of losing $1000 is as strong as the satisfaction of gaining $2000.

However, retirees are five times more sensitive to losses – an understandable response given their savings are usually at their peak and their ability to ride out any losses is far lower than when they were in the workforce.

To put it in dollar terms, losing $1000 for a retiree is as painful as the satisfaction received from gaining $5000. A substantial number of retirees were even more hyper averse to losses.

Nearly half of retirees said that they would refuse a gamble with a 50% chance of winning $100 and a 50% chance of losing as little as $10, suggesting they weighted losses about 10 times more heavily than gains, according to the same AARP study.

Figure 1: Financial loss feels worse for retirees

Source: AARP and the American Council of Life Insurers

This type of emotional bias is a prime reason investors withdraw funds at poor times. When markets fall, fear makes investors sell and, when markets go up, greed spurs investors to buy. The result is that they often lock in losses or end up over-paying for assets.

This emotional reaction reverses the ‘buy low, sell high’ mantra.

But while retirees in particular show extremely high sensitivity to losses, they also shy away from guarantees that require giving up control.

Typical products designed to minimise losses and deliver guaranteed income, such as annuities, were particularly unpopular among retirees displaying hyper loss aversion, according to the AARP and the American Council of Life Insurers study.

Giving up control over when to withdraw their own money appears to be viewed as just another form of loss even in exchange for protection against a large fall in the stock market.

This attitude is also reflected locally. Few Australians purchase either lifetime or fixed term annuity products to provide a retirement income. At least 94% of pension assets are in account-based pensions (which allow lump sum withdrawals), according to the government’s Financial System Inquiry. These retirees typically withdraw the minimum pension legally required, attempting to live frugally to protect themselves against the risk of outliving their savings.

It has prompted the government to work with the industry to increase the focus on income-generating options for retirees with the upcoming launch of comprehensive income products for retirement (CIPR), which will be pre-selected as a default option for investors. This new hybrid product is aimed at providing improved longevity risk protection without removing personal choice and freedom, although the specifics of the product are still being defined.

However, while default options are valuable in changing behaviour, they also risk creating low engagement levels – an issue many super funds (supported by a 9.5% super guarantee) grapple with – and shunting investors into inappropriate products.

Managing loss aversion: A more comprehensive approach

A weak start to 2016 across a number of markets, including the S&P/ASX 200 Index which declined by more than 20% off last year’s peak, presents another test for investors keen to avoid falling into the loss aversion trap.

Financial advisers have a key role to play.

Setting a firm financial plan, which includes investing rules, before big shifts in the markets stir up emotions, forms a key part of tackling the loss aversion bias. For example, a plan may include a stop-loss strategy to limit potential losses and have a target sell point (or trailing stop-losses) to lock in gains.

When emotions are running high and markets are volatile, these investing rules serve as a point of reason. It is also driving the use of sophisticated institutional risk management techniques, such as futures-based risk overlays, by retail investors who need protection against broad-based market declines or volatility.

Another strategy to control emotion is to divide a portfolio into buckets for different purposes: certain amounts for short- to medium-term income and longer-term growth. This ‘bucket strategy’ or ‘time segmentation strategy’ is one attempt to tackle the tendency of investors to sell out of markets at the worst possible time.

It can act as a calming influence to know they have enough cash to support their income needs no matter where markets are headed in the next two to three years. However, while the bucket strategy is a powerful tool to combat loss aversion, it doesn’t manage the actual underlying risk in a portfolio (an issue we tackled in this article).

Markets don’t always undergo ‘mean reversion’ and retirees’ cash reserves can run out before markets recover. While the magnitude of the loss aversion bias for many retirees may be excessive, the risks they are reacting to are real. The S&P/ASX 200 Index is still well off its 2007 record high.

Figure 2: S&P/ASX 200 Index Performance

Source: Milliman

While investors need a range of ongoing strategies to tackle behavioural biases such as loss aversion, the industry also needs to acknowledge and work within the confines of those biases. A purely rational solution (such as offering lifetime annuities), which ignores the realities of investor behaviour, is doomed to fail.

The government’s over-arching Financial System Inquiry encouraged product providers and distributors to take greater responsibility for the design and distribution of products by taking into account behavioural biases and improving communication.

While their concern was rightfully focused on protecting consumers from collapses, it also foreshadows a future of more flexible products which manage the risk concerns of retirees in a more nuanced manner.

It is only through a combination of these strategies – financial advice and education combined with truly flexible and effective risk management practices – that the loss aversion bias can be controlled, allowing investors to reach their retirement goals.

This document has been prepared by Milliman Pty Ltd ABN 51 093 828 418 AFSL 340679 (Milliman AU) for provision to Australian financial services (AFS) licensees and their representatives, [and for other persons who are wholesale clients under section 761G of the Corporations Act].

To the extent that this document may contain financial product advice, it is general advice only as it does not take into account the objectives, financial situation or needs of any particular person. Further, any such general advice does not relate to any particular financial product and is not intended to influence any person in making a decision in relation to a particular financial product. No remuneration (including a commission) or other benefit is received by Milliman AU or its associates in relation to any advice in this document apart from that which it would receive without giving such advice. No recommendation, opinion, offer, solicitation or advertisement to buy or sell any financial products or acquire any services of the type referred to or to adopt any particular investment strategy is made in this document to any person.

The information in relation to the types of financial products or services referred to in this document reflects the opinions of Milliman AU at the time the information is prepared and may not be representative of the views of Milliman, Inc., Milliman Financial Risk Management LLC, or any other company in the Milliman group (Milliman group). If AFS licensees or their representatives give any advice to their clients based on the information in this document they must take full responsibility for that advice having satisfied themselves as to the accuracy of the information and opinions expressed and must not expressly or impliedly attribute the advice or any part of it to Milliman AU or any other company in the Milliman group. Further, any person making an investment decision taking into account the information in this document must satisfy themselves as to the accuracy of the information and opinions expressed. Many of the types of products and services described or referred to in this document involve significant risks and may not be suitable for all investors. No advice in relation to products or services of the type referred to should be given or any decision made or transaction entered into based on the information in this document. Any disclosure document for particular financial products should be obtained from the provider of those products and read and all relevant risks must be fully understood and an independent determination made, after obtaining any required professional advice, that such financial products, services or transactions are appropriate having regard to the investor's objectives, financial situation or needs.

All investment involves risks. Any discussion of risks contained in this document with respect to any type of product or service should not be considered to be a disclosure of all risks or a complete discussion of the risks involved.

Any index performance information is for illustrative purposes only, does not represent the performance of any actual investment or portfolio. It is not possible to invest directly in an index.